What’s the difference between reviews vs. testimonials?

90% of people who read positive online reviews say it’s the reviews that help convince them to make a purchase. Testimonials, on the other hand, are 89% effective at convincing people to make a purchase. So, what’s the difference between reviews and testimonials? And aren’t they the same thing? While reviews and testimonials can help you reach the same goals for your insurance agency- namely, increased sales. They aren’t exactly the same. We’ll explore the definitions, similarities, and differences in today’s article and why insurance agents should make it a priority to gather both.

Well, third-party sites collect and display reviews. For instance, customers can leave reviews for your agency on your Google My Business listing, or Facebook page. Testimonials are similar to reviews, except the business itself collects the customer’s review and displays it. With a testimonial, you solicit the customer’s review and use it in your promotional materials. Although you can ask customers to leave a review on a third-party site, reviews posted in these locations tend to happen organically.

What are reviews?

Gone are the days when reviews were the sole domain of professional critics. Nowadays, reviews have been democratized thanks to the internet. Anyone can leave a review for your business online, which has its pros and cons. You don’t have much control over reviews like you would with testimonials. A happy customer can leave a glowing review for your business. But at the same time, so can a disgruntled client, spurned former employee, or spiteful competitor.

In general, customers respond to reviews favorably. Customers are just as likely to trust an online review as a recommendation from a friend. However, people aren’t stupid. They realize that reviews are unedited, and anyone can post a review online. So, people tend to take both good and bad reviews with a grain of salt. Mostly, people look for patterns in online reviews and use them to get a decent feel or impression on how the company operates and performs.

How much do reviews help businesses?

Let’s look at Amazon, one of the biggest online retailers, as an example. Research on Amazon shoppers and product reviews has found that shoppers check online reviews for a product before they agree to buy it. Reviews can not only unveil how well-made a product is, but the reviews can also reveal how the product works and if it will meet the customer’s specific needs. Furthermore, having just one good review increases the chances of getting a sale by as much as 65%.

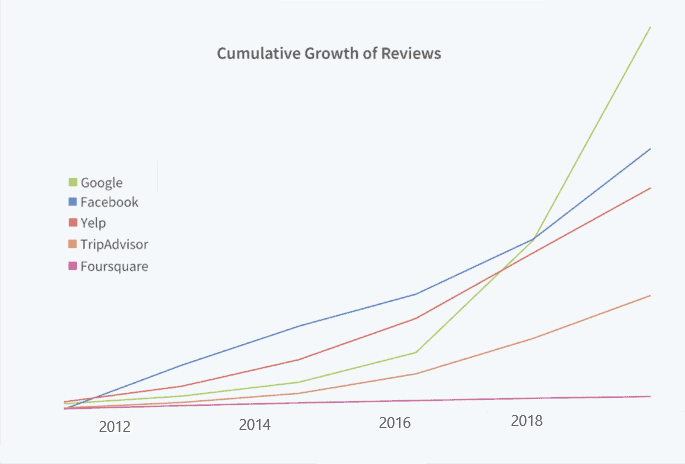

A review gives a product or service social proof and helps alleviate customer uncertainty. Most businesses, including insurance agencies, can expect to garner a range of both positive and negative reviews on third-party sites. But of course, having an overall favorable review profile is ideal. With professional services like insurance, online, third-party reviews are playing an increasingly important role in finding new clients. Industry-specific industries, especially Google and Facebook, are essential in building a strong online profile. Check out the chart below to see industry review platform leaders over the past decade.

We feel your pain.

Insurance agents may find review sites frustrating and stressful because they can’t control the content. That’s understandable. Fake reviews can find their way onto your business profile. A manipulative competitor can also leave behind fake, bad reviews to make your agency look unprofessional. And if you’ve ever had to fire an employee, you might worry that they’ll leave a bad review. A reputation or review management service can help you control for some of these issues. But overall it’s simply not possible to prevent or take down every fake, lousy review that comes your way

But let’s not get bogged down in the negative aspects of reviews. Good reviews for your insurance agency can work a lot like customer referrals. Regardless, a good, honest review is a decent reflection of the quality of your insurance services. If you hold your business to high standards, the amount and content of your reviews will reflect that. And, you’ll end up getting great reviews for your business that will help you find new customers, and close new business.

What are testimonials?

A testimonial is a solicited review that you ask a client for, and then you control the distribution of the content. So a testimonial is very similar to a review, just that your insurance agency owns the material and you can put it where ever you like. You can display the testimonial directly on your insurance agency website, post it to your Google My Business Listing, or place it in other marketing materials.

What are the results you can get from testimonials? Well, just like reviews, they can be mixed. A positive testimonial can accurately portray to readers that you know how to please your clients and deliver a positive experience. But the other thing with testimonials is that readers do understand that you’ve solicited the material, and control it. While testimonials can be an excellent way to showcase your talents, readers tend to take them with a grain of salt.

So with this in mind, you still want to use testimonials to your advantage. Unlike reviews, which are more hands-off, you can develop strategies for your testimonials so they’ll have the most impact. Use testimonials to showcase specific strengths of your agency. A testimonial can help differentiate your insurance business from your competitors.

Testimonial Best Practices

- Make sure the testimonial uses specific comments. Vague praise may be effective with a third-party review, but not a testimonial. One strategy you can use to send your best clients a short testimonial questionnaire that makes it easy for them to leave specific comments you can highlight in your future marketing materials. Ask the client to leave a comment on what service they most benefited from and what they gained from your company.

- Use a picture of the client or a video to give the testimonial weight. Putting a face to the comment or using a video will improve social proof when viewers can put a real face to the comments.

- Long-form testimonials are beneficial, and if you’ve got a testimonial that seems like a major success story, don’t let the opportunity go to waste. This type of testimonial can be crafted into a case study that shows the entire relationship you and your business have with the client and how you’ve helped them, in a story format. Case studies told in a narrative-type style are some of the most effective ways to promote your business.

Should You Use Both Reviews and Testimonials?

Testimonials and reviews can work well together to help your insurance agency find new leads and customers, and also retain current ones. Testimonials are all about your business’s relationship with the clients you have now. Plus, any client who leaves a testimonial is likely to continue doing business with you long-term.

But a review is something you don’t control. Reviews are outward-facing, and customers who search for an insurance agent near them on Google are likely to find your business and look through your review profile. Reviews let new leads know if a company is good or not. They can attract or repel potential clients. As long as third-party review sites exist, you’ll always run the risk of having fake, bad reviews as part of your profile. But that’s just the cost of doing business in the digital age.

But you can fill in any gaps you may have in your business reputation with testimonials. Customers who write a testimonial are more likely to give you word-of-mouth referrals and also leave positive reviews for your business on places like Google or Facebook. Understanding the power and strategy behind both reviews and testimonials will do a lot for your insurance business. You’ll improve your SEO, website traffic, and agency foot traffic.

Our Bottom Line

Gone are the days when gatekeepers were in charge of a business’s reputation. The consumer’s voice is now paramount in how new prospects will view your company. Either in a favorable or less favorable light. For insurance agents to remain competitive and increase their client base, understanding the importance of both reviews and testimonials is critical. You need to know how they work together to boost your agency’s reputation.

Are you ready to gain more valuable insight into the customer experience? Contact us at Lift Local today to request a demo on our review management services. We are industry experts when it comes to boosting your agency and would love to answer any questions you may have.